Loki Improvement Proposal: POS Scheme Pulse

Recently we released our fifth Loki Improvement Proposal in which we outlined a new Proof of Stake scheme, Pulse. If it’s to be implemented, Pulse would have Service Nodes produce blocks, order transactions, and secure the blockchain, rendering miners in the Loki ecosystem no longer necessary.

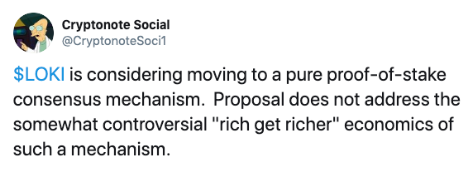

While we’re excited about the potential of Pulse, and the improvements it can bring to Loki’s suite of privacy tools, we’re aware it has raised some questions and concerns within the community. The main one being: “Won’t it Just Make the Rich Richer?”

Transitioning from Proof of Work to Proof of Stake

Let’s imagine Loki transitions from its current Proof of Work / Proof of Service hybrid consensus mechanism to Pulse (Proof of Stake). In this scenario, the Loki Network will be made up of two parties: Stakers and Non-Stakers.

Stakers are those who are running a Service Node, either by themselves, or with others in a pool. They have enough $LOKI to do so.

Non-Stakers are those who aren’t running a Service Node, because they don’t have enough $LOKI to meet the staking threshold, or because they’re choosing to hold their $LOKI instead.

Service Nodes

With Pulse, Service Nodes will create blocks in the Loki blockchain every two minutes, and receive a reward ($LOKI) for doing so. Ninety-five percent of that reward will go to the Service Node Staker (or Stakers, if it’s a pool), and the remaining five percent will go to the Loki Foundation.

In order to run a Service Node, we recommends you stake at least twenty-five percent of the full staking requirement. At the time of writing, that is roughly 5,200 $LOKI, which equates to about 1,400 USD. So Stakers – those that have enough (and choose) to stake the recommended amount of $LOKI – will increase their wealth through the accrual of rewards.

Furthermore, each time a Service Node creates a block, the overall monetary supply of $LOKI increases. Just like in a traditional economy, assuming everything in the market stays constant, when the monetary supply increases, so does the inflation rate. And when the inflation rate goes up, the purchasing power of the currency goes down. This means everybody’s $LOKI buys a little less than it did before. This is an unfortunate (but not uncommon) side effect for those that hold (and don’t stake) currency.

However, the inflation situation is the same with Proof of Work consensus mechanisms. When miners create blocks, they also receive rewards, which in turn increases the overall monetary supply and drives inflation up.

One major difference between Proof of Work and Proof of Stake consensus mechanisms is the size of the barrier to entry. The initial investment (fixed cost) required to mine cryptocurrencies – specialised hardware, constant electricity, and a high-speed internet connection – is much higher than the cost of running a Service Node – which is essentially the cost of renting and maintaining a VPS. In essence, you need a lot more financial resources to be a miner, than to be a Staker.

Of course, in reality everything in the market does not stay constant. The real-world market cap of $LOKI fluctuates, and if it increases, everyone’s purchasing power increases. Same goes the other way. Regardless, there still exists an inequality caused by the barriers to entry for mining or staking. However, a barrier to entry is necessary* in order to keep the Loki Network protected from malicious activities like Sybil Attacks.

Low barrier of entry allows more people to benefit from POS

The lower barrier to entry for Service Node operators is why Pulse is an attractive prospect for Loki. It means more people have the opportunity to participate in the rewards-based ecosystem (especially when compared to Proof of Work). Ideally, it also means more Service Nodes are in operation on the Loki Network, making our privacy products better for all. So we think it’s a win-win.

We love that our community is engaged, and challenges us to be better, which is why we’ve endeavoured to answer this question. If you have more, please keep them coming on our various social media channels.